Budget Terms and Concepts

Organizational Structure

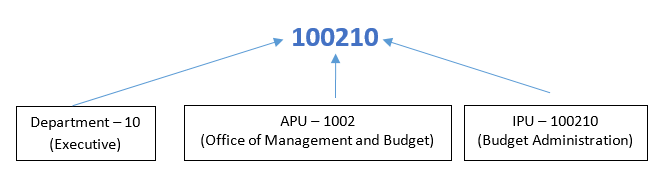

The State of Delaware is organized into a three-tiered structure with levels for the Department, APU and IPU; a department, division and section structure. Within Solver, the structure is represented with a six digit numeric field.

Common Terms And Data Structures

Agency (Department) - Any board, department, bureau or commission of the State that receives an appropriation under the Appropriations Act of the General Assembly.

Appropriation Unit (APU) - Major subdivision within a department/agency comprised of one or more Internal Program Units (e.g. Budget Administration 10-02-10 - “10-02” is the APU).

Internal Program Unit (IPU) - Major subdivision within an Appropriation Unit. Key level for budget development and tracking (e.g. Budget Administration 10-02-10 - “10-02-10” is the IPU).

Fiscal Year (FY)

The State of Delaware operates with a fiscal year that begins on July 1 and ends on June 30 and is

defined

by the ending of the period. For example, FY 2021 will begin on July 1, 2020 and end on June 30, 2021;

the

Budget Request phase for FY 2022 will begin in August 2020.

Budget Phase

Budget phases are stored in Solver using a structure called Transaction Category (TC). BREQ is the

Request

process, BREC is the Recommend process and BFIN is the Mark-up/Final process. In addition to the

processes, a transaction category called GL or General Ledger is maintained; this is where the prior

year

actuals data is stored.

Budgetary Fund

For the Operating Budget, the system currently has three budgetary funds: General Fund (GF),

Appropriated

Special Fund (ASF) and Non-Appropriated Special Fund (NSF).

General Fund (GF) - Primary fund of the State, all tax and other fines, fees and permit proceeds are deposited here unless specific legislative authority has been granted to allow the revenue to be deposited in another fund.

Appropriated Special Funds (ASF) - A type of funding appropriated in the Appropriation Act. Revenue generated by fees for specific, self-sufficient programs.

Non-Appropriated Special Funds (NSF) - Funds that are not appropriated by the legislature. Federal funds, school local funds, reimbursements and donations fall into the NSF category.

While Solver publication reports currently have only three budgetary funds. Additionally, Transportation Trust Fund Operating (TFO) and Transportation Trust Fund Capital (TFC) fund types can also be found within working reports and the Budget Act for Department 55.

Trust Fund Operating (TFO) - All revenues dedicated to the Department of Transportation are deposited into the Transportation Trust Fund. The department uses TFO to reflect operating authority/expenditures; these are currently not identified separately in Solver publication reports.

Trust Fund Capital (TFC) - All revenues dedicated to the

Department of

Transportation

are deposited into

the Transportation Trust Fund. The department uses TFC to reflect capital authority/expenditures;

these

are currently not identified separately in Solver publication reports.

Appropriation

Budget legislation is enacted at the appropriation level. An appropriation is a budgetary tool used in

governmental accounting to control spending. It is an authorization granted by the Legislature to make

expenditures and incur obligations for specific purposes. An appropriation is usually limited in the

amount and in the time which it may be expended. Currently, appropriation codes are stored within

Solver

and FSF as five-digit alphanumeric fields.

FSF has a policy to only add new appropriation numbers once they have been appropriated through the legislature. During the request and recommend phases, proposed appropriations must be entered into the budget using pseudo coded appropriations. These temporary appropriations are prefaced with a “Z” code.

Alternate Appropriation

For budgeting, NSF is shown as a rolled up BDS## appropriation that doesn't exisit in

FSF or PHRST. For NSF positions, please enter the true FSF appropriation number, if available, as the

Alt

Appropriation.

Account

Appropriations are further broken down by account codes. This is the most granular level of budget

detail

for the operating budget. For Solver and FSF, accounts are five-digits alphanumeric. Account ranges

determine whether the line is

Expense or Revenue. For budgeting purposes all revenue is lumped into account 49999 – Revenue

Control Account. Expense accounts can range from 50000 to 59999. Account code level restrictions

should be

capable of matching FSF parameters,

as provided in the FSF account trees.

Service Levels

There are five funding categories (Base, Inflation and Volume, Structural Changes, Enhancements and

One-Times) by which agency operating budget requests and recommendations are developed.

Base

The base budget reflects 100 percent of the prior fiscal year budget plus the Salary/OEC contingency

within OMB.

Base budget values are loaded from the previous year’s final budget. Policy driven adjustments can be made to the base values using an unpublished service level within Solver called Base Adjustments. Reductions in agency budgets are typically made in the Base service level.

Inflation & Volume Adjustments

Items considered critical to the continued operation of the agency such as caseload increases and

contract

inflators.

Structural Changes

Reallocation of funding or positions within or between budget units or departments. All structural

changes

must net to zero by fund or position type.

Enhancements

New programs and expansion of current services are entered at this level.

One-Time Items

A non-recurring expense not built into an agency’s base budget. Approved one-time appropriations are

budgeted within OMB, Contingencies and One-Time Items.

Budgetary Amounts

The budget system stores values as thousands, rounded to the nearest hundred as one decimal place. For

example $5,500.00 is stored as $5.5. The smallest amount that the budget system will hold is $100

stored

as $0.1.

Position

An aggregate of responsibilities and duties, filled or vacant, that requires the services of an

employee,

part-time or full-time, for which funds have been budgeted and which has been assigned to a class.

Class

All positions sufficiently similar in duties, responsibilities and qualification requirements to use

the

same examination, salary range and title.

FTE (Full-Time Equivalent)

One full-time position (30+ hours/week).

FSF Fund

FSF Fund is a code used by the state accounting system to comply with GAAP reporting requirements.

Stored

as a 3 digit numeric code, the ranges correspond with Standard GAAP Funds Types (General Fund, Special

Revenue Fund, Capital Projects Fund, Debt Service Fund, Proprietary Fund, Fiduciary Funds and

Component

Units). Fund is assigned to the appropriation within an organizational unit. This fund code is

different

from the Budgetary Fund used by Solver.

Project/Project Detail

Project/Project Detail is an internal mechanism within the budget system that allows grouping of

appropriations into major and minor projects. This grouping is primarily used for reporting purposes.

Projects

| P001 | Personnel Costs |

| P002 | Travel |

| P003 | Contractual Services |

| P004 | Energy |

| P005 | Supplies and Materials |

| P006 | Capital Outlay |

| P007 | Debt Service |

| P008 | Other Items |

| P009 | Contractual / Supplies |

| P010 | Operations / Capital |

| P011 | Revenue |

There are one or more project detail codes within a project grouping. Many of the projects have only

one

project detail. For example: P005 Supplies and Materials has only one project detail – P005-000005

Supplies and Materials.

Note: P008 Other Items has the most Project Details with over 2,000. Examples are provided below:

| P008-000001 | Other Items |

| P008-000005 | 403B Plans |

| P008-000006 | 529 Plans |

| P008-000008 | Absalom Jones Building |

| P008-000009 | Academic Excellence Block Grant |

| P008-000010 | Academic Incentive |

| P008-000011 | Accelerated Academic Fund |

| P008-000012 | Accountability & Inst Advancement |

Project Detail groupings are assigned as one Project Detail per Appropriation per Organizational Unit. The results are visible from our published reports.

Project Detail descriptions can be seen on the left of the page, broken down by budgetary fund.

Data Elements That Form A Record Within Solver

Appropriation Assignment Record

Budget records are attached to an appropriation. Before an appropriation can be used, it must be

assigned

to an organization. The previous budget system (BDIS) defined this combination as an Organization Cost

Account (OCA). Currently, Solver doesn’t use the OCA terminology for user screens; however, within the

system, appropriation assignment records are stored with a transaction category of TC[OCA].

The OCA record assigns the budgetary fund, appropriation, project/project detail and FSF GAAP fund to an IPU.

Budget Record

Budget Records are attached to an appropriation within an IPU. Each record contains:

- Appropriation;

- Account number for revenue (49999) or expense (50000-59999);

- Transaction category to define the phase (BREQ, BREC, BFIN, GL);

- Transaction type (A for actuals or B for budget records);

- D3 code to define the Service Level (BASE, ADJBAS, ADJVOL, ADJSTR, ADJENH, ADJONE, ADJMU); and

- Amount.

The rest of the information for the record is derived from the appropriation assignment record that is attached to the IPU/appropriation combination (OCA). This relationship attaches the budgetary fund, project/project detail and FSF GAAP Fund.

FTE Position Record

FTE Position Record is structured like the Budget Record described in the previous section. It is

stored

in a separate module for positions. Records that display positions in budget reports are stored in a

scenario called BUD. These records cannot be directly entered. These

records are calculated from the FTE Constituent Records described in the next section. Totals are

calculated each time you save position form data

FTE Constituent Record

The FTE Constituent Records use a scenario called BUD_POS. Throughout the system, budget forms and

reports do not query the BUD_POS records. BUD_POS records are only shown in specific reports like

BREQ-Positions. As mentioned above, the records are used to calculate position totals for budget

reports